What Could Target Do in the Future to Further Develop Its Strengths in Store Brands

Company: Target Corporation

CEO: Brian Cornell

Founders: George Dayton

Yr founded: 1902

Headquarter: Minneapolis, Minnesota, The states

Number of Employees (Oct 2020):368,000

Type: Public

Ticker Symbol: TGT

Annual Acquirement (Feb 2019): $78.1 Billion

Profit |Cyberspace income (Feb 2019): $2.937 billion

Products & Services: Beauty and wellness products, bedding, clothing, and others

Competitors:Walmart | Amazon | Best Buy | CVS | Walgreens | TJX companies | Macy'south | Costco | Home Depot | Lowe's | Kroger |

Fun Fact:

Target Corporation is amongst the x largest employers in the U.s. of America.

Introduction

Target Corporation was formed in 1902 in Minnesota, United States. The visitor is reputed for providing differentiated merchandise to its customers at disbelieve prices, ranging from luxury products to everyday essentials. Their suite of fulfillment options, loyalty offerings, devotion towards innovation, advanced engineering, and efficient supply chain has enabled Target to provide their customers with the preferred shopping experience.

The disciplined approach adopted by the organization towards business management has opened new routes for future growth. For facilitation of customers, the presence of digital channels has made it easier for purchasing the products.

Allow's reveal the competitive advantages of Target Corporation by exploring its latest dynamic through a SWOT analysis as information technology has allowed it to attain potency in the retail industry of the US.

Target's Strengths (Internal Strategic Factors)

-

Wide Range of Merchandise – One stop shop for all items including Pharmacy, Grocery, designer clothes, accessories, electronics, sporting goods, home décor, etc. For the do good of customers, their digital channels also offer a wide range of merchandise along with gratis assortment. In March 2020, Target joined the listing of a few retail stores that benefited from the panic buying of essential goods. Fifty-fifty though the company's acquirement from dress, accessories, home décor, and sporting goods declined, it saw a more than 50% rise in same-store sales thanks to a rise in demand for groceries, foodstuffs, toiletries, and other essential goods. [1]

-

Brand positioning – They provide trendy, fashionable merchandise of high quality at discounted prices for their customers. The client base of operations that Target attracts is medium to high-income group families with a median household annual income of $64K.

-

Customer shopping experience – Target offers a better experience to customers as compared to Walmart through an improved floor plan, amend shopping carts, clean store surround, and well-lit and marked aisles. The retailer has attained immense success in trying time thanks to its store-centric fulfillment model. The effectiveness of Target's shop-axial fulfillment model contributed to the growth of same-day services by 278% in the commencement quarter of 2020. The fact that nearly 90% of its online orders were fulfilled swiftly through stores highlights that Target'south investment in customer experience, satisfaction, and fulfillment is paying off. [2]

-

Designer apparels – For maximum satisfaction of customers and provision of variety, Target offers designer apparel in their stores by partnering with elite fashion designers. Roughly 20% ($15 Billion) of their total acquirement ($75 Billion) comes from "wearing apparel and accessories" segment.

- Partnership with Starbucks – The partnership of Target Corporation with Starbucks is highly constructive for increased sales every bit Starbucks drives traffic to target stores.

-

Clemency work in the community – Philanthropy is a cadre value of Target Corporation, which is evident from its program sponsorships and donations. Since 1946, the Target Foundation has been distributing v % of its profit (four million each week) to the local communities towards kids' education, nutrient drives, disaster preparedness, and relief efforts.

-

Efficient System of Distribution – To allocate the vast majority of merchandise, Target Corporation utilizes its 40 distribution centers and collaborates with common carriers for shipment of general merchandise.

-

Market Presence: Target has a strong presence in the US market. They accept a total of 1844 stores in 49 The states states, with the nigh number of stores in California (287), Texas (150) and Florida (123).

-

Effective Inventory Management – Various forms of replenishment and inventory management techniques (demand forecasting, planning, vendor management, seasonality) are adopted to minimize spoilage, lost sales, and inventory markdowns. Target added inventory planning software in Q3 of 2019 to maintain optimum inventory levels without leading to stockouts or interrupting the flow of backroom operations. The retailer is as well planning to adopt a robotic sorting arrangement to manage its inventory at the warehouses. [3]

-

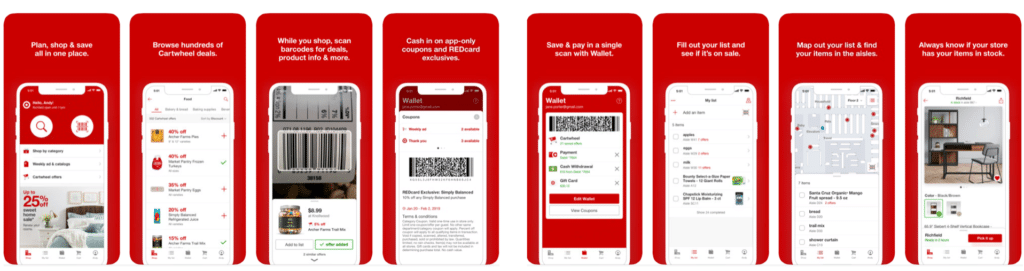

Digital Services (App) – Target has created an splendid app, "Cartwheel," for its digitally savvy customers. Through cartwheel app, Target shoppers can order online, check store inventory, check prices, notice items by aisle location, admission coupons/ offers, browse items, checkout, manage a credit card, etc.

-

Effective Adoption of East-Commerce – In 2020, Target leveraged e-commerce very effectively to fulfill the needs of its customers. The effective adoption of e-commerce resulted in a 195% increment in digital sales in Q2 of 2020. Target'south same-solar day services grew by 273% , driven by the success of its in-store pick-up, Drive upwardly and Shipt, which increased its total quarterly acquirement by 25% to $22.98 billion. Target is at present one of the meridian three e-commerce giants, forth with Amazon and Walmart. [4]

- Potent Financial Growth – Target is on its 11 sequent quarters of positive sales growth and salubrious performance in-shop and online sales channels. In FY 2019, net earnings increased from $ii.94 billion in FY 2018 to $3.28 billion. Target increased its online sales and in-store growth charge per unit farther in 2020. Its turn a profit for the fiscal second quarter of 2020 increased past 80.3% to $ane.seven billion . Target has built a sustainable business model that will continue to catalyze potent topline growth, bottom-line functioning, and high profitability in the long-term. [5]

-

Robust Omnichannel Model – Target's years of investment in its supply chains and inventory visibility beyond both online and in-store channels have delivered i of the all-time omnichannel models in the retail sector. It enabled the company to pin very chop-chop from the in-shop model to curbside pickup, transport from store, and other online/in-store sales methods. In April 2020, Target's digital sales increased by 282% year-over-year, with 80% of digital orders being fulfilled in its stores. [6]

Target's Weaknesses (Internal Strategic Factors)

-

Expensive – Co-ordinate to a report conducted past business insider, Target charges almost 15% more for groceries compared to Walmart, their biggest competitor.

- Customer Information Security – In 2014, Target had faced ane of the worst data breach incidents. Near 70 one thousand thousand customers' credit/ debit card data was stolen. AS a effect, information technology has negatively impacted Target's reputation, and they had faced many class-action lawsuits.

-

Piffling presence in the International Market place – Target has failed to expand into the international marketplace. From 2011-2015, Target had opened 133 stores in Canada. Notwithstanding, their expansion to the international market was a big failure, and soon, Target had to close down all of its stores in Canada.

- Store-Centric Approach – In the digital age, retailers have to adopt an e-commerce-first approach. Even though Target is one of a few retailers that has benefited from the rise in online shopping, a turn down in brick-and-mortar sales is undercutting gains online. Target'south sales of apparel and accessories have too declined, which is worrying because these are low-margin items. A refuse in sales of low-margin products has a bigger bear upon on the profits. [vii]

Target'due south Opportunities (External Strategic Factors)

-

Target's partnership with CVS – In Dec of 2015, CVS Wellness had acquired Target's clinic and chemist's business concern for nearly $1.9 Billion. What it means is that the Target pharmacy section is managed and operated by CVS wellness at present. It gives Target customers a neat opportunity to access industry-leading health care services in their stores.

-

Small – Format Stores – Target Corporation has been opening small-format stores that are located in dumbo urban areas and college campuses, etc. These stores are roughly 1-third of the size of their normal average size stores. The company opened its 100 th modest-format store in the summertime of 2019, with total sales through these stores exceeding $ane billion by the end of 2019. In 2021, the visitor will innovate its starting time meaty small-format stores of about 6,000 square feet in densely congested neighborhoods and college campuses. Also, it plans to open almost iii dozen new small stores ranging from 12,000 to twoscore,000 square feet. Small-format stores accept immense potential and tin drive Target'due south growth for many years to come. [viii]

-

REDcard Rewards Loyalty Plan – Target has a great opportunity to expand its REDcard loyalty program, allowing information technology to gain insights nearly changing customer habits and their preference. This volition also provide them access to customer data for marketing and promotions.

-

Same Day Delivery – Target has acquired a grocery delivery service Shipt for $550 million to provide same-day delivery like Amazon and Walmart to accelerate its attempt of digital fulfillment. In 2020, Target has focused on calculation Bulldoze Up for grocery pickup in dozens of its small-format locations to expand same-twenty-four hour period delivery service further. [9]

-

Expand Private-Characterization Brands – Another central opportunity for Target is to develop its own portfolio of private label brands. Private label brands help differentiate retailers, and they carry higher margins.

-

Increase Market Presence – Target has increased the number of stores from 1,844 to over 1,868 stores in 2020, which increases its market presence. Most of its new stores are mega shopping centers that stock everything from apparel to electronics and groceries. Nearly lxxx% of Target's stores are 50,000 to 169,999 square feet , and 15% are bigger than 170,000 square feet. The remaining five% are pocket-size-format stores that are smaller 49,999 foursquare feet. [10]

- Store Remodeling – While renovation might seem similar a modest investment, it has a loftier return on investment (ROI). By the end of 2020, Target expects to complete remodeling its 300 stores to bring the total of remodeled stores to 1000 . Each remodeled store will see an increase in sales of between 2% and 4% in the kickoff year alone and tin can maintain at over 2% in the next few years. If sales in all its m remodeled stores increase by an average of three%, the total revenue generated will ascension by a broad margin. Shop remodeling is a major growth opportunity for Target. [11]

Target's Threat (External Strategic Factors)

-

Local Contest –Target operates in a highly competitive and low margin industry. Its major competitors like Walmart, Costco, Kroger, Home Depot, etc. have numerous stores located shut to the local population, thus impacting their market share. To counter potent contest in the e-commerce sector from Amazon, Target commenced its holiday flavour deals in October. It also expanded its Black Friday pricing for the whole of November with nearly 1 meg more deals . The company has to spend more and more to continue up with the frontrunners, which will continue into its profits every bit the competition increases. [12]

-

Changing Client Preferences –The performance of Target Corporation may accept intense negative implications due to the growing trends of online shopping. The growth streak of competitors like Amazon is moving further, pushing its supply concatenation direction with online shopping. Although it may create opportunities for growth, still the logistics expansion and on-time delivery past Amazon towards changing customer demands may pressurize and create difficulties for Target to compete in populated hubs.

-

Failure to differentiate –The failure to differentiate may serve equally a threat to Target Corporation. Their make loyalty may exist afflicted due to the shift of numerous shoppers towards emotionless and price-sensitive online shopping.

-

Vulnerable to Economic Downfall –Target sales are highly dependent upon the macroeconomic factors. Since most of their stores are in the US market, when there is a turbulence in the health of the US economy, Target'due south business is also negatively impacted.

-

Low Barrier to Entry – The retail concern, although majuscule intensive, is easily replicable. Any new visitor can undercut Target'south prices and accept a large share of the market.

-

Market Uncertainties – Uncertainties in both local and global markets has impacted the bottom line of many retailers. Even though Target has not been affected significantly, the uncertainties have forced the company to revise its projections and expansion plans. The visitor announced that information technology is downsizing its shop remodeling plans from 3000 to only 300 due to market uncertainties. [xiii]

-

Rising Costs – Target'due south Q1 profit plunged by 64% due to ascent costs of doing business concern. Although online sales increased by 141% and quarterly revenue rose 11.three% to $19.37 billion, the company spent virtually $500 million to maintain safety measures. The loftier cost of doing business eroded its gains leading to a decline in net earnings from $795 million in Q4 2019 to $284 million in Q1 2020. [fourteen]

Conclusion

Deriving immense level of client loyalty and benefiting from globalization, Target Corporation equally one of the reputed retailers in the U.s..

In spite of this, it is necessary for the entity to consider all material aspects that may negative implications on the organization. Thus, this SWOT analysis of Target evaluates the strength, weakness, opportunity, and threat, which Target Corporation encounters in its corresponding market.

References & more data

- Venugopal, A. (2020, Mar 25). Sales of essential goods at Target soar in March as shoppers stock upwardly . Reuters

- Kapadia, S. (2020, Aug 17). Target's investments in store-centric fulfillment pay off . Supply Chain Swoop

- Leonard, M. (2020, Jun 5). Target's program for a store-fulfillment manager . Supply Chain Swoop

- Perez, S. (2020, Aug nineteen). Target sets sales tape in Q2 as same-day services abound 273% . Tech Crunch

- Repko, M. (2020, Aug xix). Target reports a monster quarter — profits leap 80%, aforementioned-store sales set a record . CNBC

- Alpha Staff (2020, May 14). Target: Riding The Wave Of Omni Channel Retail In 2020 . Seeking Alpha

- Repko, M. (2020, Apr 23). Target'due south shares tumble as retailer says first-quarter profits will be hurt by higher costs . CNBC

- Genovese, D. (2020, Mar 24). Target's small stores getting even smaller . FOX Business concern

- Springer, J. (2020, Aug. 19). Target Refires Bulldoze-Upward Grocery . Win Sight Grocery

- Redman, R. (2020, Mar 03). Target accelerates the omnichannel game plan . Supermarket News

- Unglesbee, B. (2020, Mar 24). Target plans a 6K-square-pes store as it ramps upwards small format expansion . Retail Dive

- Balu, N. (2020, Sept. 29). Target to start holiday discounts in October, take on Amazon's Prime 24-hour interval . Reuters

- Kline, D. (2020, Mar 25). Target Downsizes Its 2020 Store Remodels Due to Coronavirus . The Motley Fool

- Kalluvila, Southward. (2020, May 20). Target profit sinks 64% equally COVID-19 costs offset gains from sales surge . Reuters

Tell u.s.a. what you think? Did y'all find this article interesting? Share your thoughts and experiences in the comments section below.

Related posts:

wilkinsoptale1948.blogspot.com

Source: https://bstrategyhub.com/targets-swot-analysis/